What Does Paul B Insurance Insurance Agent For Medicare Huntington Mean?

Currently no insurers are providing Medicare Select insurance in New York State. Medicare Advantage Strategies are authorized and also regulated by the federal government's Centers for Medicare and also Medicaid Solutions (CMS).

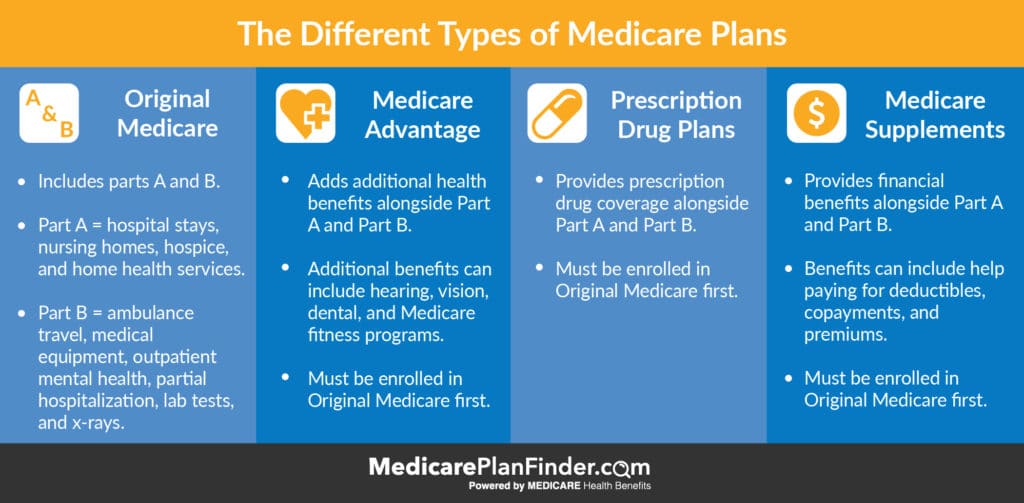

What is Medicare Benefit? What are the benefits as well as limitations of Medicare Advantage plans? Are there any protections if I register in a strategy and also do not like it? Are any Medicare Managed Care Program offered where I live? Medicare Advantage expands healthcare alternatives for Medicare beneficiaries. paul b insurance Medicare Part D huntington. These alternatives were developed with the Well balanced Budget Plan Act of 1997 to minimize the development in Medicare costs, make the Medicare depend on fund last much longer, as well as give beneficiaries a lot more selections.

Paul B Insurance Local Medicare Agent Huntington Things To Know Before You Buy

Original Medicare will certainly constantly be available. This is a handled care plan with a network of suppliers who contract with an insurance business.

You agree to comply with the policies of the HMO and also make use of the HMO's carriers. This is similar to the Medicare Advantage HMO, other than you can utilize companies outside of the network. However, you will certainly pay greater deductibles and copayments when you go beyond the network. This is one more handled care plan.

This is an insurance coverage plan, not a managed treatment strategy (paul b insurance medicare advantage plans huntington). The plan, not Medicare, sets the fee timetable for providers, however providers can bill up to 15% more. You see any kind of providers you select, as long as the service provider concurs to accept the settlement routine. Medical necessity is figured out by the plan.

The 8-Minute Rule for Paul B Insurance Medicare Advantage Plans Huntington

This is just one of the handled treatment strategy kinds (HMO, HMO w/pos, PPO, PSO) which is created by a religious or fraternal organization. These strategies may restrict enrollment to members of their company. This is a medical insurance policy with a high deductible ($3,000) incorporated with a savings account ($2,000).

Doctors need to be permitted to notify you of all therapy choices. The strategy must have a grievance and also appeal procedure. If a layperson would believe that a signs news and symptom might be an emergency, after that the plan has to pay for the emergency therapy. The plan click to read can not charge more than a $50 copayment for check outs to the emergency area.

You do not need a recommendation from your key treatment medical professional. All plans have a contract with the Centers for Medicare as well as Medicaid Provider (Medicare). The strategy has to enroll anyone in the service area that has Component An as well as Component B, with the exception of end-stage renal illness individuals. Each strategy should provide an annual registration duration.

What Does Paul B Insurance Insurance Agent For Medicare Huntington Mean?

All strategies may supply extra advantages or solutions not covered by Medicare. The Centers for Medicare and Medicaid Solutions (Medicare) pays the plan a set amount for each month that a beneficiary is signed up.

If you fulfill the list below requirements, the Medicare Advantage plan need to enlist you. You may be under 65 and also you can not be refuted protection because of pre-existing conditions. You have Medicare Part An as well as Component B.You pay the Medicare Component B costs. You stay in a county serviced by the plan.

You are not obtaining Medicare as a result of end-stage kidney condition. An additional sort of Medicare Managed Health Care Company is a Cost Contract HMO. These strategies have different demands for enrollment. You have Medicare Part An and also Part B, or Part B.You pay the Medicare Component B my site premium. You stay in a region serviced by the plan.

Medicare Advantage plans must give all Medicare covered solutions and also are authorized by Medicare. Medicare Advantage plans may offer some solutions that Medicare does not normally cover, such as routine physicals and also foot care, dental care, eye tests, prescriptions, hearing aids, as well as other preventative solutions. Medicare HMOs might give some services that Medicare doesn't generally cover, such as routine physicals and also foot care, oral treatment, eye exams, prescriptions, listening to help, as well as various other preventative services.

The Buzz on Paul B Insurance Medicare Advantage Plans Huntington

You do not require a Medicare supplement plan. Filing and also organizing of claims is done by the Medicare Advantage strategy.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)